How does the probate process work?

When a loved one passes away, you may find yourself tasked with having to deal with the probate process, as either an executor (under a will) or administrator (where there is no will under the rules of intestacy). This can be complicated, at what is already a difficult time. Below we run through the key stages of the process.

1. Establish if there is a will and locate it

If there is more than one Will, this can be tricky, as you need to be sure you are using the latest one and that it is valid. If there is no Will, and you are dealing with an intestacy, you may have to check the family tree carefully and locate any missing relatives.

2. Review the Will, or check the intestacy rules

You’ll need to establish who is entitled to apply for a Grant of Probate and who the beneficiaries are. Check you understand the terms of the Will, as these can be full of legalese and there may be provisions in the Wills Act 1837, which could catch you out. It’s essential to seek legal advice to ensure you don’t pay out to the wrong people.

3. Value the assets and calculate any debts owed

You will need to notify the relevant authorities (DWP, HMRC etc.), as well as utility companies, banks, etc. Part of gathering the assets will include checking any entitlements to life insurance payouts and establishing if the deceased made any gifts in the seven years leading up to their death, which might affect the amount ofInheritance Tax due. This is one of the most important stages of the process.It is essential everything is valued accurately, and the right amount of tax is paid. Getting this wrong could lead to substantial personal liability if beneficiaries lose out.

4. Prepare and send the InheritanceTax forms to HMRC

You will need to declare any gifts and relevant reliefs from Inheritance Tax, as well as transfer any unused nil rate sums from a deceased spouse to minimise the amount of tax due. Once the amount has been finalised, you need to arrange to pay anyInheritance Tax due. There are time limits for declaring and paying InheritanceTax and for making variations to the will or intestacy to take advantage of tax savings, so ensure this is completed in a timely manner to avoid incurring interest and other costs, which you may be personally liable for.

5. Submit your application for theGrant of Probate

This can only be completed once the Inheritance Tax has been declared and paid.

6. Deal with the assets

Once you’ve received the grant you are legally authorised to handle the estate. You will need to close bank accounts, sell or transfer any shares or investments, pay any outstanding bills, and sell any houses, cars, or other assets. It may be necessary to advertise for any potential creditors, who may contact you when they hear about the grant being issued – for example, if the DWP thinks the deceased may have had more assets than declared, they will request information, which could lead to a claim to repay overpaid benefits.

7. Prepare accounts.

Establish how much is left to pay out to the beneficiaries.

8. Pay out the money to the beneficiaries

If you pay too much, you could be left trying to get money back from the beneficiaries if debts or other claims arise later. HMRC can chase underpaid tax many years later, by which time the beneficiaries may well have spent the money. Don’t pay out too soon or you could find yourself struggling to get money back if someone makes a late claim against the estate which you had not expected.

9. Store the paperwork in a safe place

You may be required to present the paperwork if HMRC has any queries over the next few years, so make sure you store it in a safe place.

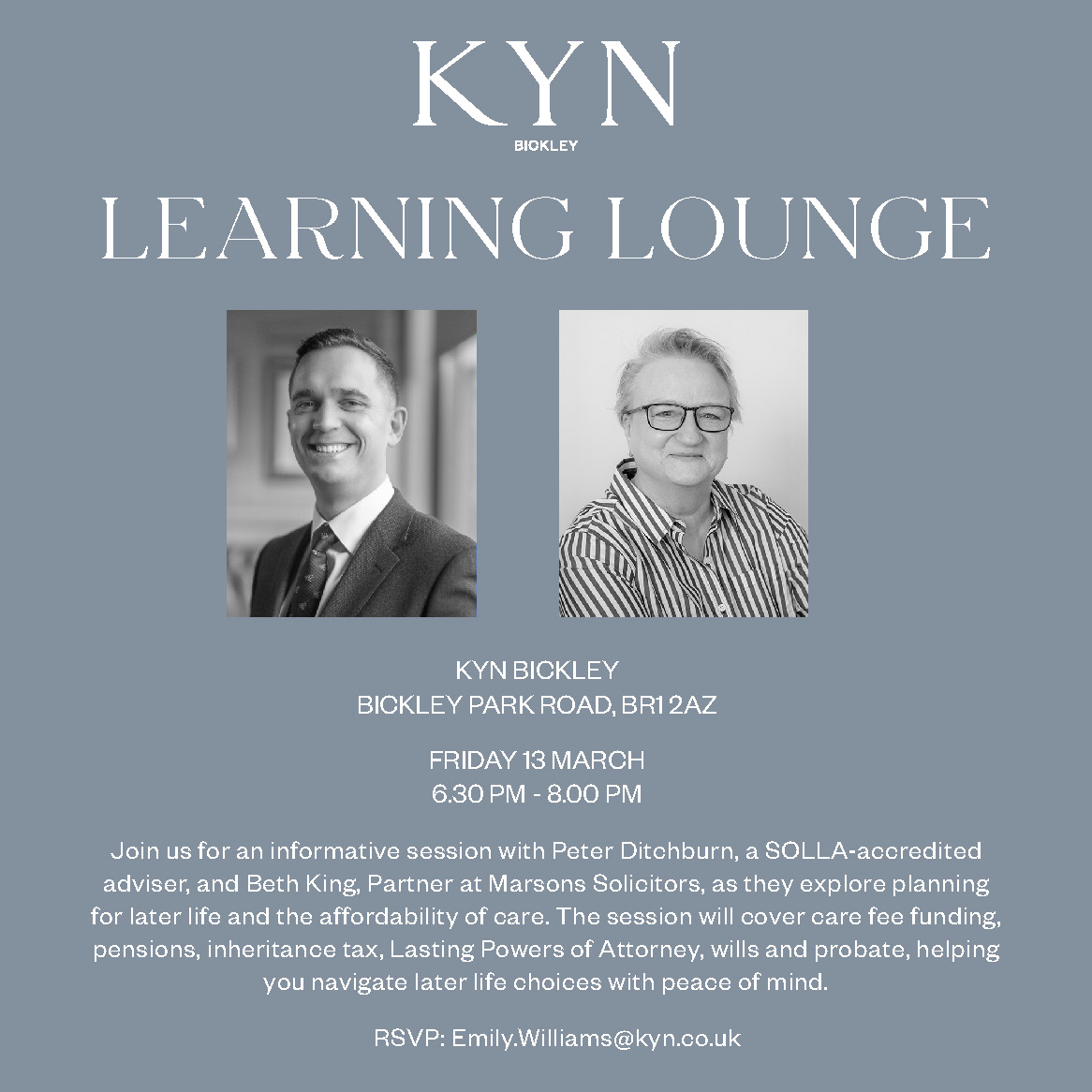

You should only deal with probate if you have the time and sufficient knowledge, so you don’t risk making expensive mistakes that could leave you financially liable. If you’d like to use a solicitor to deal with probate for you, contact Beth King for a free 15-minute probate review session to see how we can help you.

Find out more in our Probate FAQs.

The information contained in this article is intended for general guidance only. It provides useful information but it is not a substitute for obtaining legal advice as the articles do not take into account specific circumstances. So do please ContactUS for legal advice on the issues raised.

Resources

7 Dangers Executors Need to Know